NGV I 20Q1

StageZero Oy

Bankrupt 24Q1

NGV I 20Q1

Akribian AB

Bankrupt 22Q3

NGV I 20Q3

Supremacy Games Oy

Bankrupt 24Q4

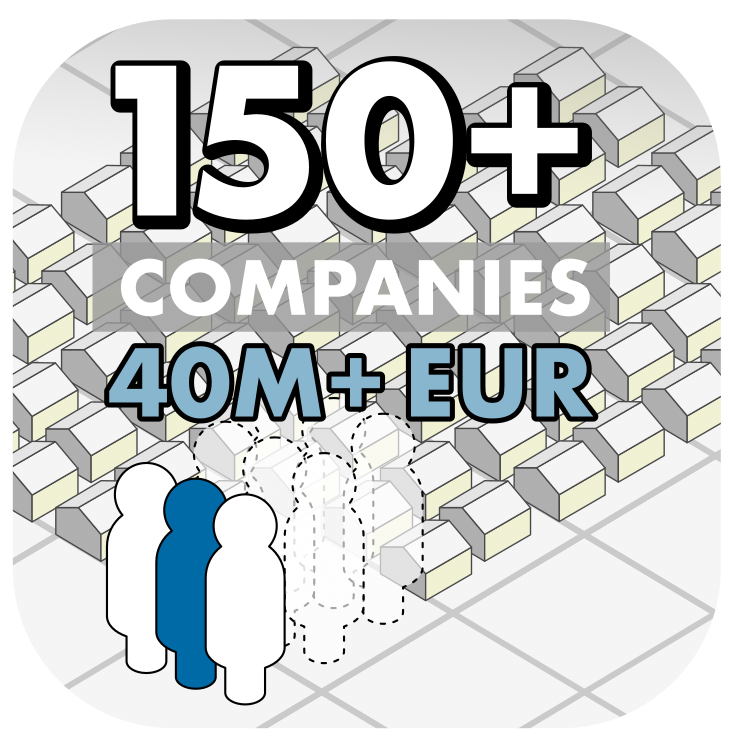

We combine 50 years of games industry experience and organisation with raising over 40 MEUR for the whole industry and for 150+ selected individual companies, as well as VC and angel investing in over 20 Nordic game companies to date. We are well known.

A close advisory group of 20+ successful games industry veterans, entrepreneurs, fund managers and analysts, from all five countries, committed to supporting and joining the Nordic Game Ventures founders and core team as fund volume requires and allows.

Our primary ESG (environmental, social and governance) factors are the following.

Environment

Energy is an issue in games, from battery life in handhelds to

costs at datacenters, driving awareness and conservation.

Social

Work and workplace issues are being debated today, and we expect our portfolio companies to lead. Diversity and gender balance will ultimately lead to better, more popular products. The companies must have a responsible approach to the appropriateness of product content, and for sensible use, for their target customer groups.

Governance

Nordic Game Ventures will strive to set an example, and require adherence to highest standards, in general conduct and reporting.

We are subjects of Financial Supervisory Authority oversight in Finland and Sweden, and full code compliant members of Pääomasijoittajat (Finnish Venture Capital Association) and SVCA (Swedish Private Equity & Venture Capital Association).

Portfolio compliance will be supported by a combination of best practice dissemination and check-list self-evaluation material.

Impact

NGV funds should not be evaluated primarily as Impact investment vehicles. However, the impact of games, and of the games medium on other fields, can possibly not be overstated. We certainly aim to foster a culture of responsibility for the games medium and its development through our investments and in our portfolio companies, while our funds are first and foremost focused on company and industry growth and profitability.

The Nordic Game Ventures funds are fully intentionally open and transparent, rather than closed private partnerships. This is of course for investor security, but also for strategic reasons.

Nordic Game Fund Management Oy received marketing permission by the Financial

Supervisory Authority in Finland in March 2019, under the EU Alternative investment

fund managers (AIFM) Directive 2011/61/EU.

https://www.finanssivalvonta.fi/en/registers/supervised-entities/

Nordic Game Ventures AB was in July 2019 registered by the Financial Supervisory

Authority in Sweden as an AIFM with EuVECA marketing permission, under

Regulation (EU) No. 345/2013 on European venture capital funds.

https://fi.se/en/our-registers/company-register/?query=nordic+game

We are currently alone in being able to offer institutional investors focused early to growth stage strategic Nordic games industry allocation in line with mandates.

Our quarterly reporting is Invest Europe code compliant, and we are full code compliant members of Pääomasijoittajat (Finnish Venture Capital Association) and SVCA (Swedish Private Equity & Venture Capital Association). We are focused on delivering overall best practice in governance, transparency and reporting.

As an investor interested in the Nordic games industry or as a Nordic game company seeking funding, we want to hear from you, and we will get back to you immediately.

Contact us at invest at nordicgame dot-vc for information on how to invest with us, and at pitch at nordicgame dot-vc if you are seeking equity investments for your company.